Our Services

MINI ATM

This Device will allow people to withdraw money from their bank accounts without visiting the Bank or an ATM. Supplementary Branch Outreach is a Mini ATM network that provides convenient banking

services to citizens. All in all, this is one of our mission to bridge the gap between the availability and accessibility of ordinary citizens providing simple banking services. The Micro ATM is invented to help people of the rural area for the financial inclusion.However, in heavy cash crunch problem like today these types of Mini ATM Machines is boon to everyone.

Key Features :

- Cash Withdrawal From All Bank

- Balance Enquiry From All Bank

- Mini Statement (subject to service availability)

- No Transaction Charges

- No MDR Charges

- Rent Free

- Attractive Commission

- Instant Settlement 24*7

- 24*7 Move to Bank Option

- Transaction Receipt

- Transaction Report

AEPS

AEPS is nothing but an Aadhaar-enabled payment system through which you can transfer funds, make payments, deposit cash,Mini Statement, make withdrawals, make enquiry about bank balance, etc. Aadhar enabled payment system is a bank led model which allows online interoperable financial transaction at PoS (Point of Sale / Micro ATM) through the Business Correspondent (BC)/Bank Mitra of any bank using the aadhaar authentication. Aadhaar fingerprint scanner and aadhaar iris scanner is most commonly used aadhaar biometric device which helps to identify the person’s identity.

Key Features :

- Cash Deposit

- Payment Transactions

- Balance Enquiry

- Cash Withdrawal

- Aadhaar to Aadhaar funds transfer

- Instant Settlement 24*7

- 24*7 Move to Bank Option

- Interoperable across multiple banks.

- Easy and secure way for cash withdrawal and balance enquiry service.

Aadhaar Pay

Aadhaar Pay is a payment system which allows merchants to collect payments from a customer using his Aadhaar number and biometric authentication. The Aadhaar seeded account of the customer gets debited and merchant account gets credited.

Features of Aadhaar Pay :

- Inter-operable

- Instant transfer, 24X7 availability

- No peripherals required for customers to make payments like cards and smart phone

- Secure and safe as it is based on biometric authentication.

Benefits to merchants :

- Seamless fund collection from customers

- Lower Transaction charges

- Safe and secure

- Instant account to account fund transfer

- Increased customer satisfaction as process saves time

- Easy reconciliation

- Eliminates cash handling cost and risk.

DMT

You can transfer money from one account to another account. Domestic means that it happens within the country, it is not an international transfer. Our platform supports IMPS and NEFT transaction modes, based on customer’s requirements and beneficiary bank.

Key Features :

- Lowest Charges

- Send money instantly

- Available 24/7

- Transfers may occur on Sundays and public holidays also

- Instant confirmation to sender by SMS

- Safe and Secure transaction

- This service is available at all branches

- Verified account transfers

Recharge

One can become our partner and add extra to your income. You can start a mobile recharge shop very easily and from your shop in your locality. Our company will provide you mobile recharge portal software for your business. You can recharge telecoms like Idea, Vodafone, Jio, Airtel etc. We are the best multi recharge app for your business and our success ratio is more than 99%. The mobile recharge retailer commission is very attractive in low investment.

Key Features:

- Start off business of an online recharge business with all in one recharge solution.

- Recharge business with high commission

- Automatic refund in case of failure

- Automatically coordinate pending recharge with various operators

- Application Notification / Desktop Notification / URL Callback will be called back when any recharge is made

- High success rate

- Support most carrier denominations/plans

- Support SMS-based recharge (no internet or offline required) for use by our retailers

- Automated operator and loop finder for prepaid mobile phones

BBPS

Bharat Bill Payment System (BBPS) is anessential system that provides an integrated, interoperable invoice payment service to customers from all regions, with transaction certainty, reliability and security. It provides customers with bill payment services through an

agent network or online, enables multiple payment modes, and provides instant confirmation via BBPS web, BBPS app, SMS or receipt .We are promoting a cashless society by shifting cash bill payments to electronic channels. Currently, you can pay bills for utilities (gas, electricity, water, DTH) and telecommunications.

Postpaid Bill Payment:

Online Utility Bill Payment Business is a profitable business for small entrepreneurs and shop owners to add extra income. As India is moving towards digital transactions so making online payments is profitable business as water bill, electricity bill, gas bill,postpaid bill, internet bill etc. become online. Fintechpay utility bill payment franchise is very easy to own as you just need to have your own shop and Smartphone or laptop.

Key Benefits ::

- Customers will enjoy the ease of paying bills anywhere, anytime by simply connecting to the BBPS network, online or through agents.

- Access to the system will be available everywhere, including the zero or minimum banking region.

- Earn highest commission in market in each BBPS

- Payment of any invoice could be made through a single portal.

- Service centers for the payment of bills will be available at the workplace or residence closest to the client.

- Bank branches, ATMs, customer service centers, etc., could be the point of sale of BBPS. A customer could make the payment from any BBPS point of sale.

- Security and reliability could be entrusted to the clients with the use of this system.

Travel

We take pride in operating our business in a professional and responsible manner. Our travel agents are inspired and guided by our basics that allow us to satisfy a large number of customers. We have created a niche in the travel market that gives us an important position between our suppliers and customers. We believe that travel is an experience in itself. Therefore, it must be easy and hassle-free. We always strive to make travel a unique experience, and our fully automated travel solution is exactly what you need. Delivery days and deadlines are important when dealing with travelers. Our ultimate goal is to provide the perfect solution for our everchanging needs. Our glorious number of clients and their testimonials can prove it about us.

Key Features :

Our agents reserve a train ticket for the customers or traveler, provide a medium for becoming an IRCTC authorized train ticketing agent, and get an instant commission on the sale of any ticket. All training and explanations will be provided to the new IRCTC ticket agent that offers best-in-class customer service. We provide a user friendly and quick interface to our online travel booking agents to book tickets for their customers through a single wallet system. The wallet can be recharged by using multiple options like Credit Card, Prepaid Card or Net Banking.

We offer domestic and international ticketing solutions with all available combination and airlines. This service offers the best routing options with an easy-to-reserve interface. This is a complete trip management solution with a single interface. Agents can instantly book and confirm tickets and earn attractive flight booking commission.

Insurance

Insurance is a mutual contract that a person buys from an insurance company by paying premiums to the insurance company on a yearly,monthly or quarterly basis. In return, the insurance company protects the buyer or policyholder against future losses or risks.

In addition to individuals, both public and private organizations can purchase insurance to protect their employees. It is basically a form of risk management system that allows the insured to obtain protection against potential incidents such as loss, sickness, death, loss of property, etc. Insurance is the only financial tool that helps you manage your financial risks smoothly and reduce your financial worries.

Why to Choose Insurance ?

Life is full of uncertainties, it is really important to buy insurance as early as possible to protect you and your family from all odds. An insurance plan not only protects you, but also provides you with mental peace. Insurance is especially important for the elderly, for whom these policies can replace their income and help themselves and their families. In addition, you can use these insurances to achieve your investment goals and to design a comfortable retirement plan. Many insurance policies also offer a loan against them, which is another benefit you can enjoy when buying insurance.

Above all, insurance will not only take care of you but also your loved ones and loved ones by paying for their different needs even when you are not there. So, choose your insurance plan carefully as there is a huge amount of insurance on the market.

You can sell the following insurance policies from all the best insurance companies in India.

- Life Insurance

- Term Insurance

- Health Insurance

- Personal Accident

- Car Insurance

- Two-wheeler Insurance

- Health Insurance

- Travel Insurance

- Home Insurance

PAN Service

Fintechpay acts as the unified platform for all services related to the application of the PAN card and all other procedures, at all. Permanent Account Number (PAN), the ten-digit number issued in the form of a laminated card by the Income Tax Department in India, counts as one of the most important document as the unique identification number allotted to each taxpayer of the country. Tax Information Network (TIN) is a contemporary system for collecting, processing, monitoring and accounting of direct taxes.

In this regard, online PAN Card Agents/UTI PSA Agents has opened retail outlets in various towns throughout the country to assist applicants in the PAN card application process. The biggest concern for PAN card applicants is how to fill out PAN card application form and where to submit it. However, you do not have to worry because they are rescued by online PAN card agents/UTI Agents that provide an efficient service to your customers.

Key Benefits ::

- Efficient and helpful Servicing Staff.

- Hassle Free work to improve customer comfort.

- Transparent procedures and responsible handling of documents.

- Time-sensitive approach to delivery.

- Enormous access to the most remote corners of every region.

- Earn Commission on each PAN card application.

FasTAG Service

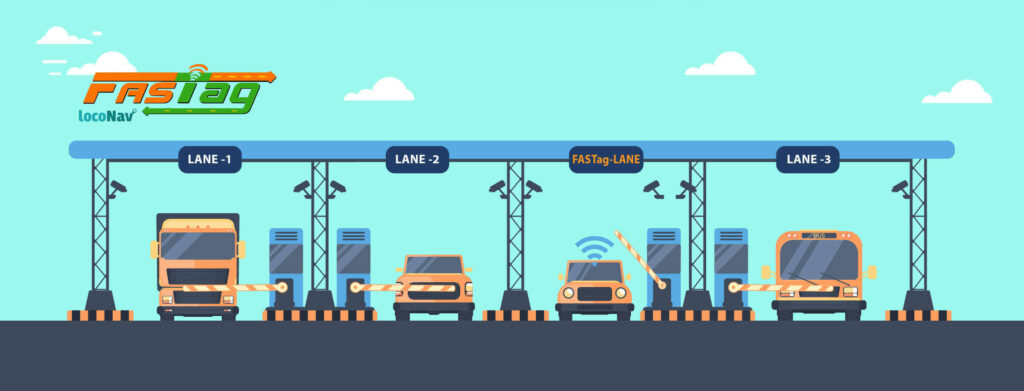

FasTag is a reloadable label that automatically deducts tolls and allows vehicles to pass through toll booths without stopping payments. It uses

radio frequency identification (RFID) technology to make cashless payments through prepaid accounts associated with it. The tag is attached to the windshield of the vehicle, and the RFID antenna in the awning of the toll booth scans the QR code and the tag identification number and then lifts the cantilever barrier to allow the vehicle to pass.

FasTag is valid for five years and comes in seven different colors-purple, orange,yellow, pink, blue, green and black. Assign a specific color to each type of vehicle. FasTag is the perfect solution for easy travel on national highways. FasTag currently operates at all toll stations on national and state highways. As per new guideline of Highway Authority of India, FasTag will become mandatory for all vehicles to pass the Toll booths in near future.

Benefits of FasTag :

For Vehicle Owners:

- Hassel free toll

- Avoid long queues

- Cash back

- Uninterrupted movement of the vehicle reduces fuel costs

- Various payment options, such as credit/debit card, NEFT, etc., can be used torecharge FasTag .

- FasTag can be associated with insurance policies to help customers eliminate the urgency of hosting policy documents.

For Toll operators:

- Convenient cashless payment

- Reduce the time required to process tolls

- Due to long queues and changes, there is no customer aggression

- Reduce operating costs

- Better audit control by centralizing user accounts

For Government:

- Better road management

- Bring transparency to paid transactions

- Reduce revenue leakage

- Strengthen project responsibility

CMS:

Cash Collection Services

There are plenty of benefits to be had by availing of our cash collection service. Your business can get a boost in terms of operational productivity as we free up your staff to focus on more urgent tasks while we do your banking on your behalf. We offer protection and reduce risks for theft – both outside and inside your organisation. Your money is insured by a nationwide cash-in-transit insurance policy if you choose Secure Cash. All these benefits you can enjoy at a cost that will not exceed your budget.

When you book our cash collection services, a designated cash-in-transit agent will work closely with you, making arrangements on intervals that work best for you, depending on the trend of your takings. Our customers are not tied to binding contracts so services are fine-tuned according to your specific needs.

This also gives you the freedom to call on us only whenever you need us or try other services. For your maximum convenience, we can certainly increase or reduce the frequency of your collections and do spot changes in your requirements.

We offer increased security on your cash processing with a level of service customised according to your organisation’s specific needs. Every business is different, which is why we build a personalised service that we feel would be the most appropriate for every customer. Nobody else knows your requirements, of course, than you yourself and if you work with us, we also give you freedom to choose the frequency and the type of service that would work best for your business.

BROWN LABEL ATM

PRODUCT SUMMARY :

Fintechpay is happy to announce new addition to its list of product and services a standard ATM machine with maximum efficiency, absolute reliability and ultimate usability which can give your business outstanding returns on its investment. ATM machine is eco-friendly, which can be run on regular power input and also compatible with TCP/IP, wireless and dial-up connections. It has capacity of 4 cassette to maximize profit with least replenishing.

What is the Status of Brown label ATMs in India :

In view of the high cost of ATM machines and RBI’s guidelines for expansion of ATMs, the concept of Brown Label ATM network is likely to expand at a brisk pace in next few years. In the recent years, there is a visible shift in the way banks look at the ATM business. From the earlier model where banks used to buy outright the ATM machines and bear the cost of service, they are now preferring brown label ATMS i.e. where the machine and service is outsourced. There are indications that as many as 50% may soon be under this category.However, after approval of white label ATMs, the bankers will review the expansion model for their ATMs.

ICICI CSP

CSP stands for customer service point which is also referred as Bank Mitra. They are the agent for the facilitating bank especially in unbanked areas of the country. They provide numerous services to unbanked people of India. We are Providing ICICI bank csp to the retailers as if they are eligible for their Location & Other Criteria.

What benefits CSP retailer gets through kiosk banking?

- An easy to use application.

- Hassle free system

- New revenue opportunity

- Goodwill and branding

- What does retailer need?

- Personal Computer

- Internet Connectivity

- Printer

- Office or retail outlet.

What are the functions and features of Kiosk banking?

- Cheque deposit

- Customer deposit

- Internet banking

- Personal inquiry

- Marketing tool

- MIS reporting

What are the benefits to the customer?

- The easy hassle free opening of the no-frill saving account.

- Kisan Credit card

- Fixed deposit and term deposit

- Loan against FDR

- Less KYC

- No queues

- Easy deposit, withdrawal, and remittance

- Other benefits like transfer subsidies, scholarship etc